Crafting a Mortgage Loan Originator Cover Letter

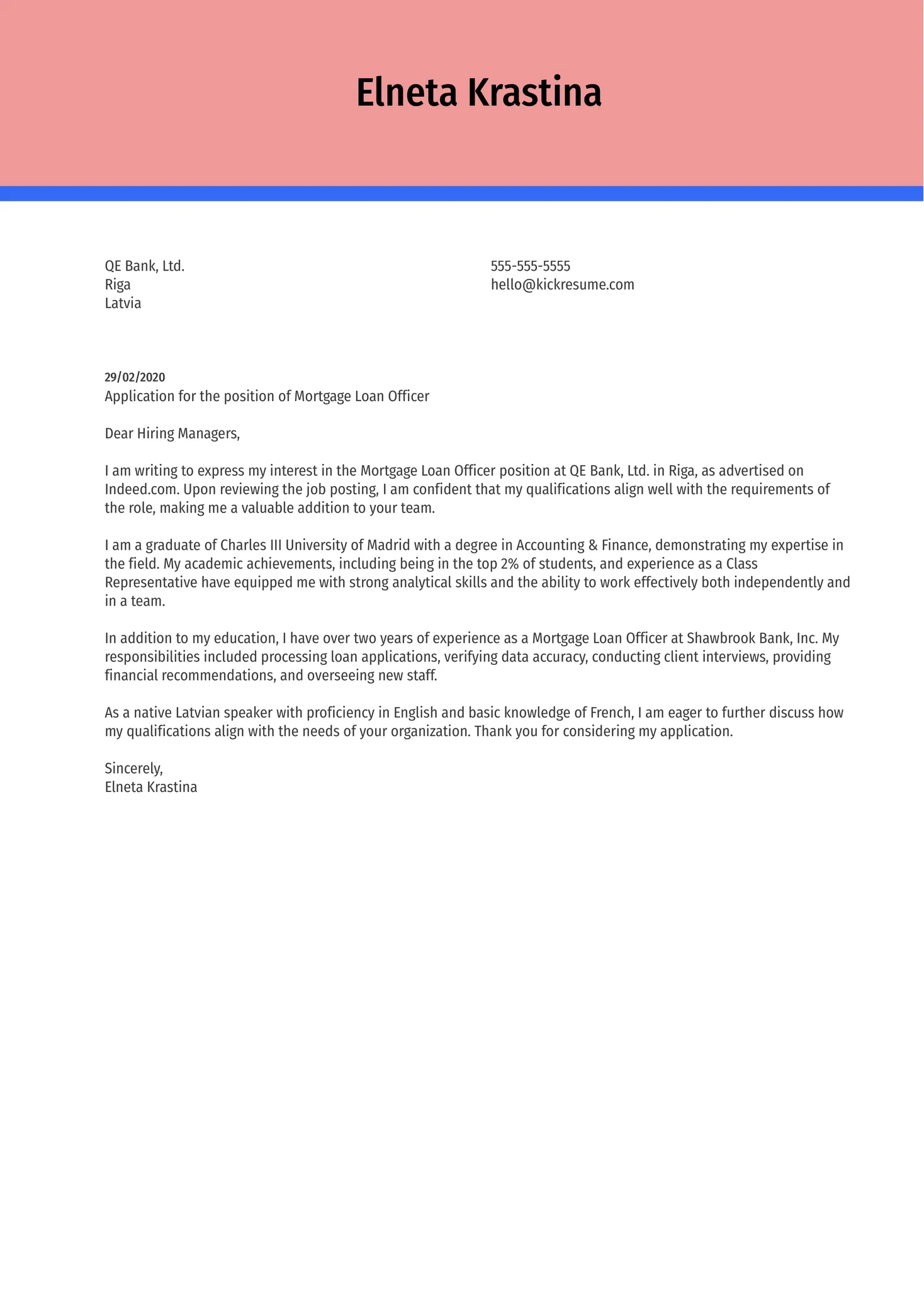

A well-crafted cover letter is your first chance to make a positive impression on a potential employer. For mortgage loan originators, the cover letter is particularly important as it allows you to showcase your skills, experience, and understanding of the mortgage industry. A cover letter complements your resume by providing a narrative that explains your qualifications and why you are the ideal candidate for the position. This guide will walk you through the essential steps of creating a compelling mortgage loan originator cover letter that captures the hiring manager’s attention and increases your chances of landing an interview.

Highlighting Your Skills and Experience

Your cover letter should prominently feature your relevant skills and experience. Begin by identifying the key skills required for the loan originator role you are applying for, such as communication, sales, customer service, and financial analysis. Clearly articulate how your past experiences have equipped you with these skills. Provide specific examples to demonstrate how you have successfully applied these skills in previous roles. For instance, if the job description emphasizes customer service, share an instance where you went above and beyond to assist a client, resolved a complex issue, or received positive feedback. This approach provides tangible evidence of your abilities.

Summarizing Your Relevant Experience

When describing your experience, focus on the roles and responsibilities that align with the job requirements. Briefly outline your work history, highlighting positions that involved loan origination, sales, or customer interaction within the financial sector. Mention the types of loans you have experience with (e.g., conventional, FHA, VA, USDA) and the markets you have served. Be concise and ensure the information is easy to understand. The goal is to present your background in a way that is directly relevant to the position, allowing the hiring manager to quickly assess your suitability for the role.

Quantifying Your Achievements

Use numbers and metrics to demonstrate your accomplishments. Instead of saying you “exceeded expectations,” provide specific figures to show your success. For example, state the number of loans you closed, the dollar amount of loans originated, or your percentage increase in sales. If you have received awards or recognition, include them in your cover letter. Quantifiable results make your achievements more convincing and provide a clear understanding of your value as a loan originator. This also shows the employer your attention to detail and ability to deliver tangible results.

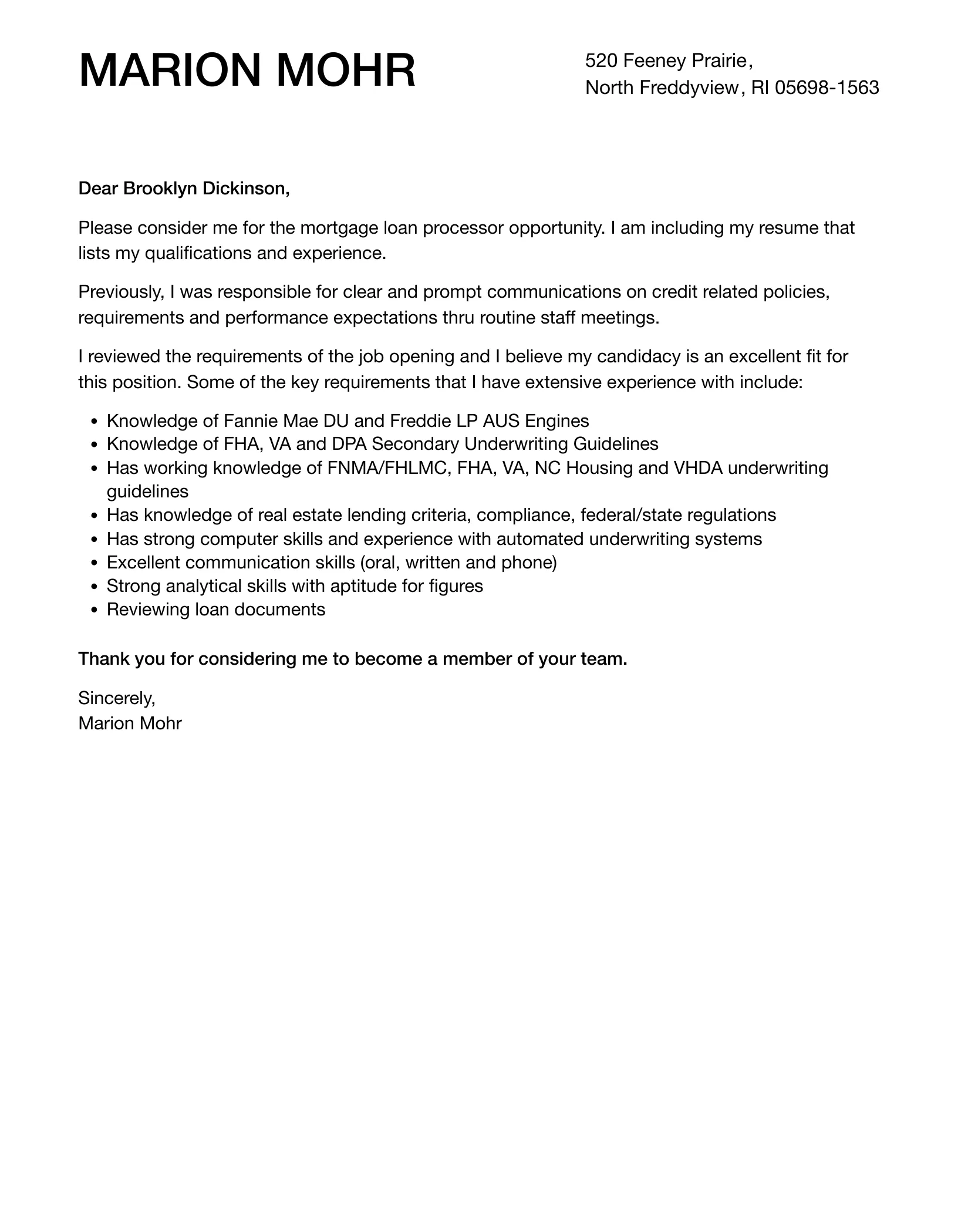

Demonstrating Industry Knowledge

Show that you are well-versed in the mortgage industry by mentioning relevant regulations, market trends, and technologies. If you are familiar with specific loan origination systems (LOS) or other industry software, list them in your cover letter. Discuss your understanding of compliance, such as the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA). This level of detail indicates your commitment to the profession and your readiness to perform the job effectively from day one. Staying updated on current market conditions and interest rates will further highlight your expertise.

Formatting Your Mortgage Loan Originator Cover Letter

The format of your cover letter is just as important as its content. A well-formatted letter is easy to read, professional, and presents you in a positive light. Pay close attention to the layout, font choice, and overall appearance of your cover letter to make a strong first impression. A properly formatted cover letter shows professionalism and attention to detail, which are crucial in the mortgage industry.

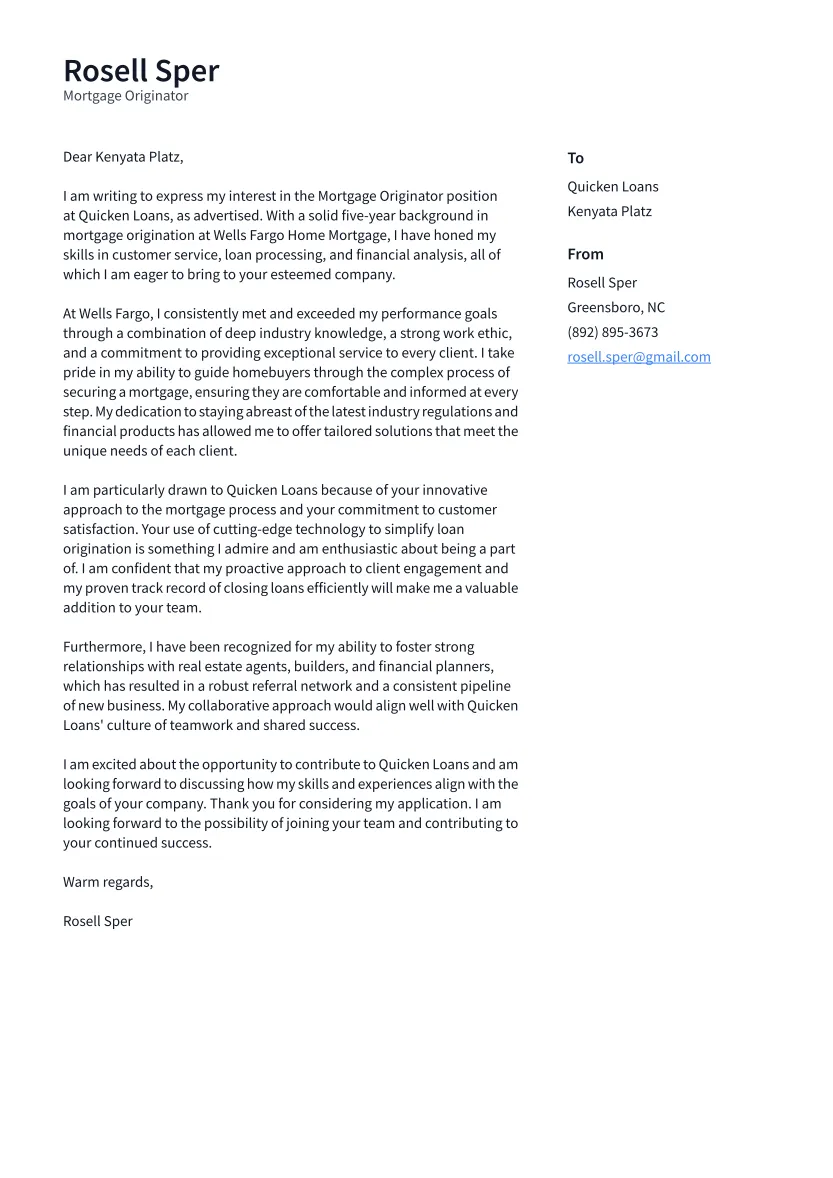

Header and Contact Information

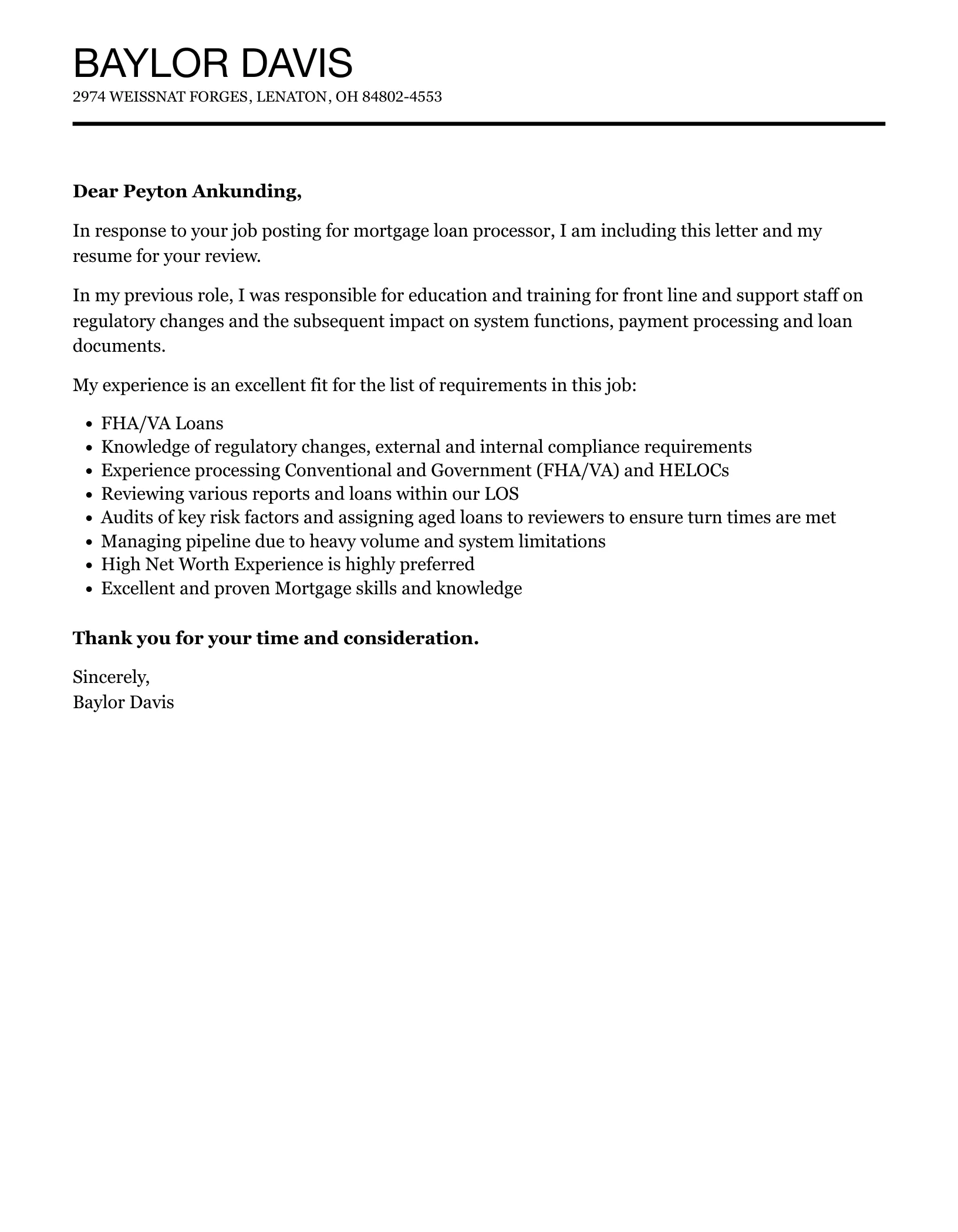

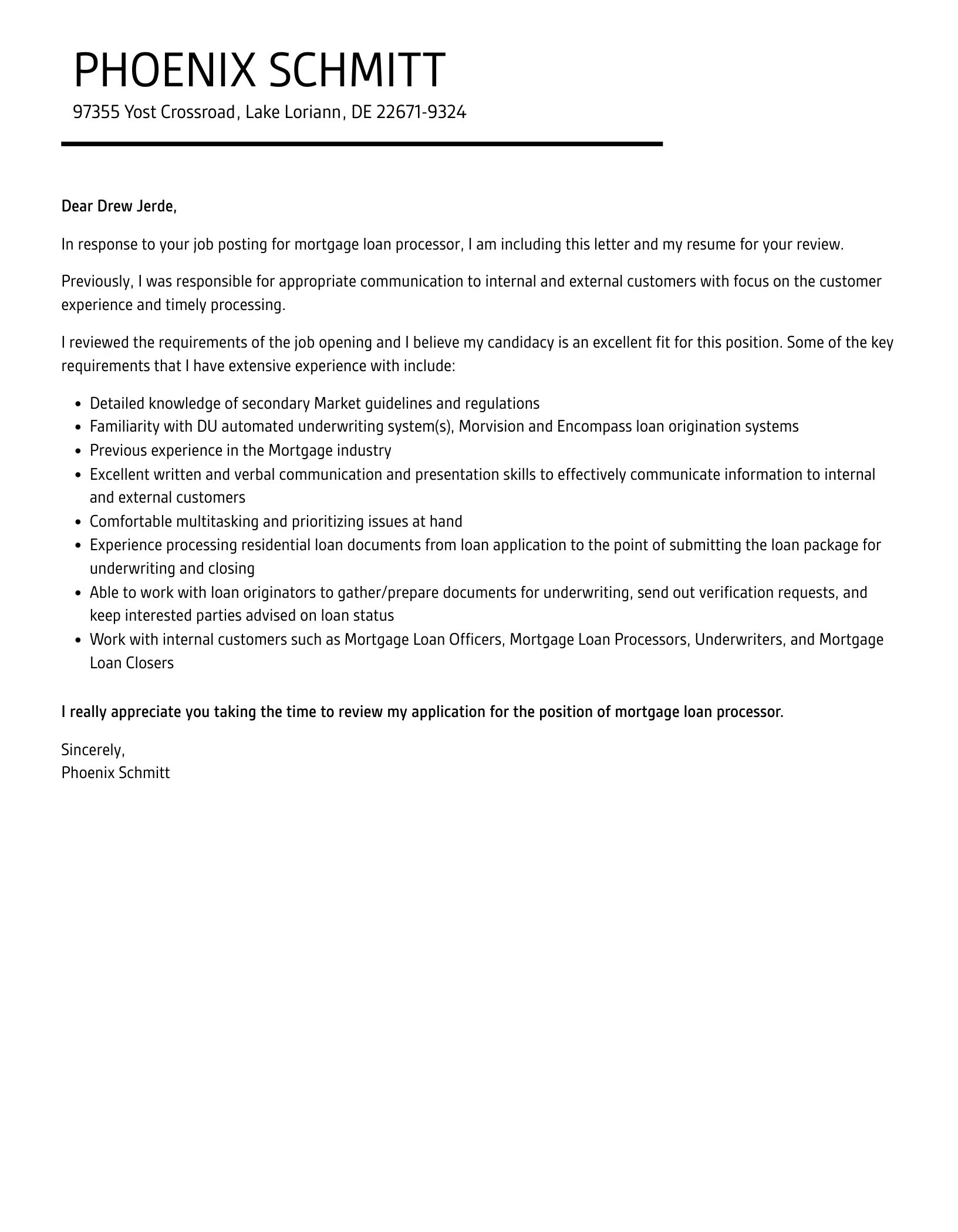

Start with a clear header that includes your name, address, phone number, and email address. Ensure your contact information is accurate and professional. Following the header, include the date and the hiring manager’s name and title, if known. If you cannot find a specific name, use a professional title such as “Hiring Manager.” This personal touch shows you have done your research and are attentive to detail, which is highly valued in the mortgage industry.

Professional Salutation

Begin your cover letter with a professional salutation, such as “Dear Mr./Ms./Mx. [Last Name]” or “Dear Hiring Manager,” if you do not know the name. Avoid using casual greetings. This demonstrates respect and sets a professional tone from the beginning. Addressing the hiring manager by name, when possible, shows you have put in the effort to personalize your application, setting you apart from generic applications.

Body Paragraphs

The body paragraphs are where you will elaborate on your skills, experience, and enthusiasm. Structure your content logically and use clear, concise language to convey your message effectively. This is your opportunity to showcase your value and make a lasting impression.

First Paragraph: Opening Statement

In your opening paragraph, state the position you are applying for and how you learned about it. Briefly mention why you are interested in the role and the company. Keep this paragraph concise and engaging, highlighting your enthusiasm and making the reader want to continue reading. A strong opening sets the stage for the rest of your cover letter.

Second Paragraph: Showcasing Achievements

Use the second paragraph to highlight your relevant achievements and skills, supporting your claims with concrete examples. Quantify your successes whenever possible. For example, mention the number of loans you have closed, your average loan size, or any awards you have received. This section provides the evidence that backs up your claims and shows the value you bring to the table.

Third Paragraph: Expressing Enthusiasm

Express your enthusiasm for the company and the specific role in the third paragraph. Explain why you are interested in working for them and how your goals align with their values and mission. Research the company beforehand, and mention any specific aspects of their work that appeal to you. This demonstrates that you have done your homework and are genuinely interested in the opportunity. Expressing enthusiasm sets you apart from other candidates who may simply be looking for a job.

Fourth Paragraph: Call to Action

Conclude with a clear call to action. State your interest in an interview and provide your contact information again. Thank the hiring manager for their time and consideration. Making it easy for the hiring manager to contact you increases your chances of being selected for an interview. This shows your confidence and initiative.

Closing Your Cover Letter

The closing is an important element of your cover letter, as it leaves a lasting impression on the hiring manager. A well-written closing reinforces your interest and professionalism. Make sure your closing is appropriate and leaves a positive impression.

Formal Closing

Use a formal closing, such as “Sincerely,” “Respectfully,” or “Best regards,” followed by your full name. Avoid casual closings like “Thanks” or “See you later.” This maintains a professional tone throughout the letter and shows that you take the application process seriously. Always proofread your closing to ensure accuracy.

Proofreading Your Cover Letter

Before submitting your cover letter, carefully proofread it for any errors in grammar, spelling, and punctuation. Typos and grammatical mistakes can undermine your professionalism and credibility. Ask a friend or colleague to review your letter as well, as a fresh pair of eyes can catch mistakes you might have missed. Ensure that your formatting is consistent and that the letter is easy to read. Proofreading is a crucial step that helps ensure your cover letter represents you in the best possible light.

In conclusion, writing a compelling mortgage loan originator cover letter requires careful planning, attention to detail, and a clear understanding of your skills and experience. By following the guidelines outlined in this article, you can craft a cover letter that will make a strong impression on hiring managers and increase your chances of landing your dream job. Remember to highlight your achievements, quantify your results, and demonstrate your industry knowledge. A well-written cover letter is your key to opening the door to new opportunities in the mortgage industry.