What to Include in a Bank Teller Cover Letter

A well-crafted bank teller cover letter is your first chance to impress a potential employer. It’s a crucial document that introduces you, highlights your relevant skills and experience, and expresses your interest in the position. Unlike a resume, which lists your qualifications, a cover letter allows you to showcase your personality and explain why you are the ideal candidate. This guide will provide you with the essential elements to include in your bank teller cover letter, helping you create a compelling application that stands out from the competition. From the initial contact information to the final closing, we’ll cover every aspect of crafting a cover letter that effectively presents your qualifications and enthusiasm for the role. Let’s dive in and create a cover letter that gets you noticed and, ultimately, secures your next job as a bank teller.

Contact Information

Accurate and professional contact information is essential for a bank teller cover letter. It ensures the hiring manager can easily reach you to schedule an interview. This section sets the tone for your application, so it must be neat, organized, and free of errors. Proper formatting and attention to detail demonstrate your professionalism and attention to detail, which are crucial qualities for a bank teller. Remember, the goal is to make it as easy as possible for the employer to contact you. By including all necessary details and presenting them clearly, you’re setting yourself up for success. Ensure that the information provided is current and easily accessible, making the recruitment process more streamlined for both you and the employer.

Applicant’s Name and Contact Details

Begin with your full name at the top of the letter. Below your name, include your phone number, email address, and optionally, your LinkedIn profile URL. Use a professional email address; avoid informal or outdated addresses. Double-check all contact information for accuracy before sending. This ensures that the hiring manager can easily reach you for an interview or further communication regarding the position. Presenting accurate and professional contact information is the first step in making a positive impression on the hiring manager. It shows your commitment to professionalism and attention to detail, which are essential qualities for a bank teller role. By providing clear and concise contact details, you increase your chances of receiving a call back and advancing in the application process.

Hiring Manager’s Information

Always address the letter to the hiring manager or the specific person in charge of recruitment if possible. If you can’t find a name, use the title of the position or a general greeting like ‘Hiring Manager’. Research the company’s website or use LinkedIn to find the hiring manager’s name. Addressing the letter to a specific person shows that you’ve taken the time to research the company and are genuinely interested in the position. It demonstrates your attention to detail and professionalism, which are important qualities for a bank teller. Personalizing your cover letter increases the chances of it being read by the intended recipient. This extra effort can set you apart from other applicants who may use a generic greeting.

Address the Hiring Manager Properly

Use a formal salutation, such as ‘Dear Mr./Ms./Mx. [Last Name]’ if you know the hiring manager’s name. If the name isn’t available, use a professional greeting like ‘Dear Hiring Manager’. Avoid casual greetings like ‘Hi’ or ‘Hello’. The tone should be professional and respectful, reflecting your understanding of the importance of the role. Use proper titles and capitalization. Addressing the hiring manager correctly sets a positive tone from the start and demonstrates your attention to detail. This is crucial for a bank teller position where accuracy and professionalism are highly valued. Taking the time to find the hiring manager’s name and address them correctly shows that you’re committed to the application process and that you’re eager to impress.

Writing the Body of Your Bank Teller Cover Letter

The body of your cover letter is where you showcase your skills, experience, and enthusiasm for the bank teller position. It should be well-structured and engaging, providing specific examples that demonstrate your qualifications. This section allows you to elaborate on your resume and explain why you’re a good fit for the role. Each paragraph should serve a specific purpose, and together, they should paint a clear picture of your value as a candidate. Using a professional tone and highlighting your relevant skills, such as customer service, cash handling, and attention to detail, will increase your chances of success. Remember to tailor the content to the specific requirements of the job and the values of the bank or financial institution. This demonstrates that you understand their needs and are prepared to meet them.

Opening Paragraph Make a Strong Impression

Start with a strong opening that immediately grabs the reader’s attention. State the position you’re applying for and where you found the job posting. Briefly mention why you’re interested in the role and the company. This paragraph should clearly state your intention and convey your enthusiasm. Avoid generic openings; instead, try to personalize your introduction by mentioning something specific about the company or the role that interests you. This makes your cover letter more memorable. In your opening paragraph, show your personality and let the hiring manager know that you’re the right fit for the bank teller position. Make sure your opening paragraph reflects your eagerness to contribute to the organization’s success. A compelling start can significantly increase the likelihood that your cover letter will be read thoroughly.

Highlight Your Relevant Skills

In the body of your cover letter, highlight the skills most relevant to a bank teller position. Tailor the skills to match the job description, but common skills to emphasize include customer service, cash handling, attention to detail, and problem-solving abilities. Use specific examples to demonstrate how you’ve used these skills in previous roles. For example, when discussing customer service, describe a situation where you resolved a customer’s issue or exceeded their expectations. For cash handling, describe your experience with balancing cash drawers or processing transactions accurately. Be specific and avoid vague statements. Showing rather than telling makes your qualifications more convincing. Back up your claims with data whenever possible. The purpose is to convince the hiring manager that you possess the necessary skills for the role.

Customer Service Experience

Customer service is a core aspect of the bank teller role, so it’s crucial to showcase your experience. Describe instances where you provided excellent customer service, resolved customer issues, or handled difficult situations with professionalism. Mention any specific customer service training you’ve received or any awards or recognition you’ve earned for your customer service skills. Provide concrete examples of how you went above and beyond to assist customers, such as by explaining complex financial products or helping them navigate banking procedures. Consider mentioning any specific customer service metrics you’ve met or exceeded, such as customer satisfaction scores or positive feedback received. Emphasize your ability to communicate effectively, listen actively, and build rapport with customers, as these are all essential for success in the bank teller role.

Cash Handling Experience

Cash handling experience is critical for a bank teller. Detail your experience in handling cash, balancing cash drawers, processing transactions, and detecting counterfeit money. Include specific figures, such as the average amount of cash you handle daily or the accuracy rate of your cash drawer reconciliation. Mention any training or certifications you have in cash handling procedures. Describe any systems you’ve used for cash management, such as automated teller machines (ATMs) or point-of-sale (POS) systems. Highlight your attention to detail and your commitment to maintaining accuracy. Emphasize your ability to follow proper procedures, maintain confidentiality, and adhere to safety regulations. Demonstrate a solid understanding of cash handling best practices and your commitment to preventing fraud and ensuring the security of transactions. This will convince the hiring manager of your competence in this area.

Attention to Detail

Detail and accuracy are crucial for bank tellers. Provide examples of your ability to pay attention to detail and handle financial transactions accurately. Mention any experiences where you caught errors or discrepancies. Describe specific processes or systems you use to maintain accuracy, such as double-checking your work or using checklists. Explain your ability to follow procedures and adhere to bank policies. Highlight any experiences where you managed to prevent fraud or reduce errors. Show the hiring manager that you understand the importance of accuracy and how to maintain it. Describe the ways you ensure that you do your work carefully and precisely, minimizing mistakes. Demonstrate your awareness of the impact of errors in financial transactions and your commitment to preventing them. Showcasing your attention to detail is critical to reassure the employer that you can be trusted.

Problem-Solving Skills

Highlight your problem-solving skills and how you resolve customer issues. Describe situations where you identified and solved problems, such as resolving customer inquiries, handling complaints, or troubleshooting technical issues. Provide specific examples of how you approached problems, what actions you took, and what the outcomes were. Showcase your ability to think critically, analyze information, and find effective solutions. Mention your ability to make quick decisions under pressure. Explain how you can analyze complex situations and effectively resolve customer issues. This skill is highly valued in a bank teller role, as it directly impacts customer satisfaction and the smooth operation of the bank. Showing your ability to solve problems is a strong selling point.

Quantify Your Achievements

Whenever possible, quantify your achievements to demonstrate the impact of your skills. Use numbers to illustrate your accomplishments and make your claims more credible. For example, mention the percentage increase in customer satisfaction scores you achieved, the number of transactions you processed accurately per day, or the amount of money you saved the bank by identifying fraudulent activities. Provide specific data points that show your performance and your impact on the organization. Numbers and data make your achievements more tangible and easier for the hiring manager to assess. Use metrics such as transaction volume, customer satisfaction scores, or efficiency gains to highlight your successes. When you quantify your achievements, you’re able to substantiate your claims and provide evidence of your capabilities.

Closing Your Cover Letter

The closing of your cover letter is an opportunity to reiterate your interest in the position and express your gratitude for the hiring manager’s time. It should leave a positive impression and encourage the hiring manager to contact you. The closing should be concise and professional, summarizing your key qualifications and emphasizing your enthusiasm. A strong closing paragraph will increase your chances of being called for an interview. A thoughtful and well-written closing paragraph can significantly impact the overall impression you leave. Remember to keep it professional and focused, restating your interest, and expressing thanks.

Express Enthusiasm and Gratitude

Reiterate your interest in the position and express your enthusiasm for the opportunity. Thank the hiring manager for their time and consideration. State that you are eager to learn more about the role and the bank. Briefly summarize why you are the best fit for the position, and reaffirm your value to the company. Conclude by stating that you look forward to hearing from them soon. Mention any follow-up plans, if appropriate. End with a professional closing, such as ‘Sincerely’ or ‘Best regards,’ followed by your full name. Expressing enthusiasm and gratitude ensures that the hiring manager remembers you and your eagerness to join the bank. This will leave a lasting impression and increase your chances of being selected for an interview. A professional and enthusiastic tone demonstrates your commitment and interest.

Proofread and Edit

Before submitting your cover letter, meticulously proofread and edit it. Check for grammar, spelling, punctuation, and formatting errors. Make sure your writing is clear, concise, and easy to read. Ensure your cover letter is free of errors, as this is an essential step in showcasing your attention to detail. Ask a friend or family member to review your cover letter for a fresh perspective. Use grammar and spell-check tools, but don’t rely on them entirely. Review the letter carefully for any inconsistencies or awkward phrasing. Errors in your cover letter can undermine your credibility and demonstrate a lack of attention to detail, which is essential for a bank teller role. Taking the time to proofread and edit your cover letter demonstrates your professionalism and commitment to excellence. Ensure your cover letter is polished and ready to impress the hiring manager.

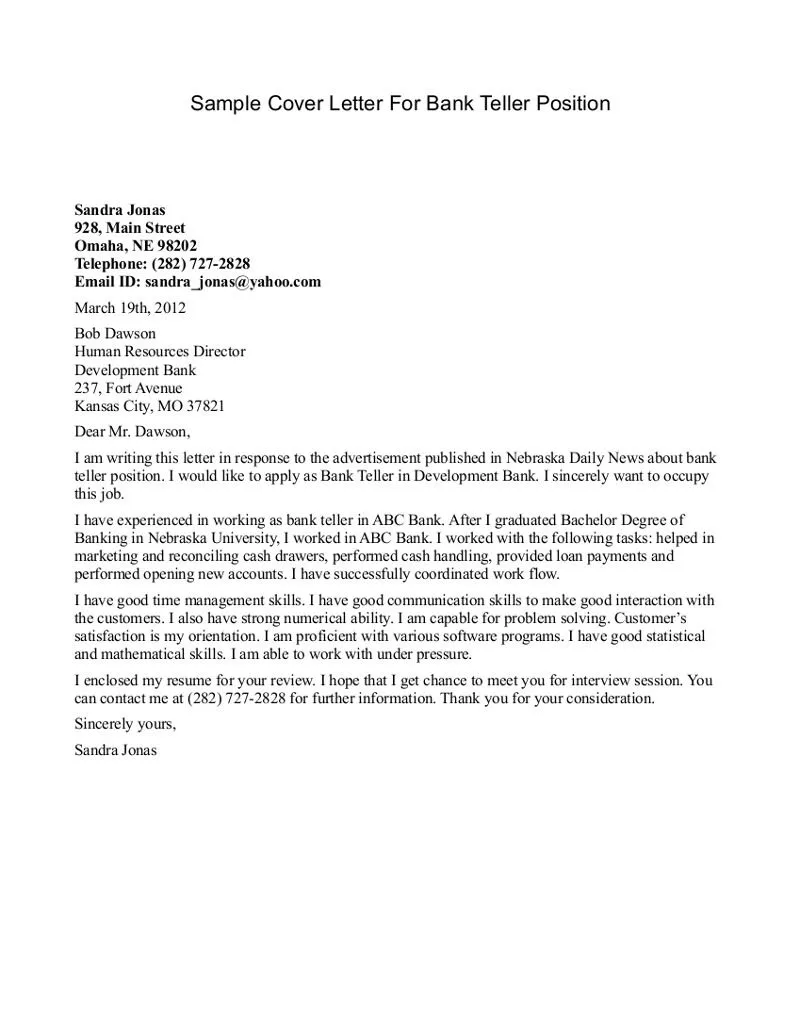

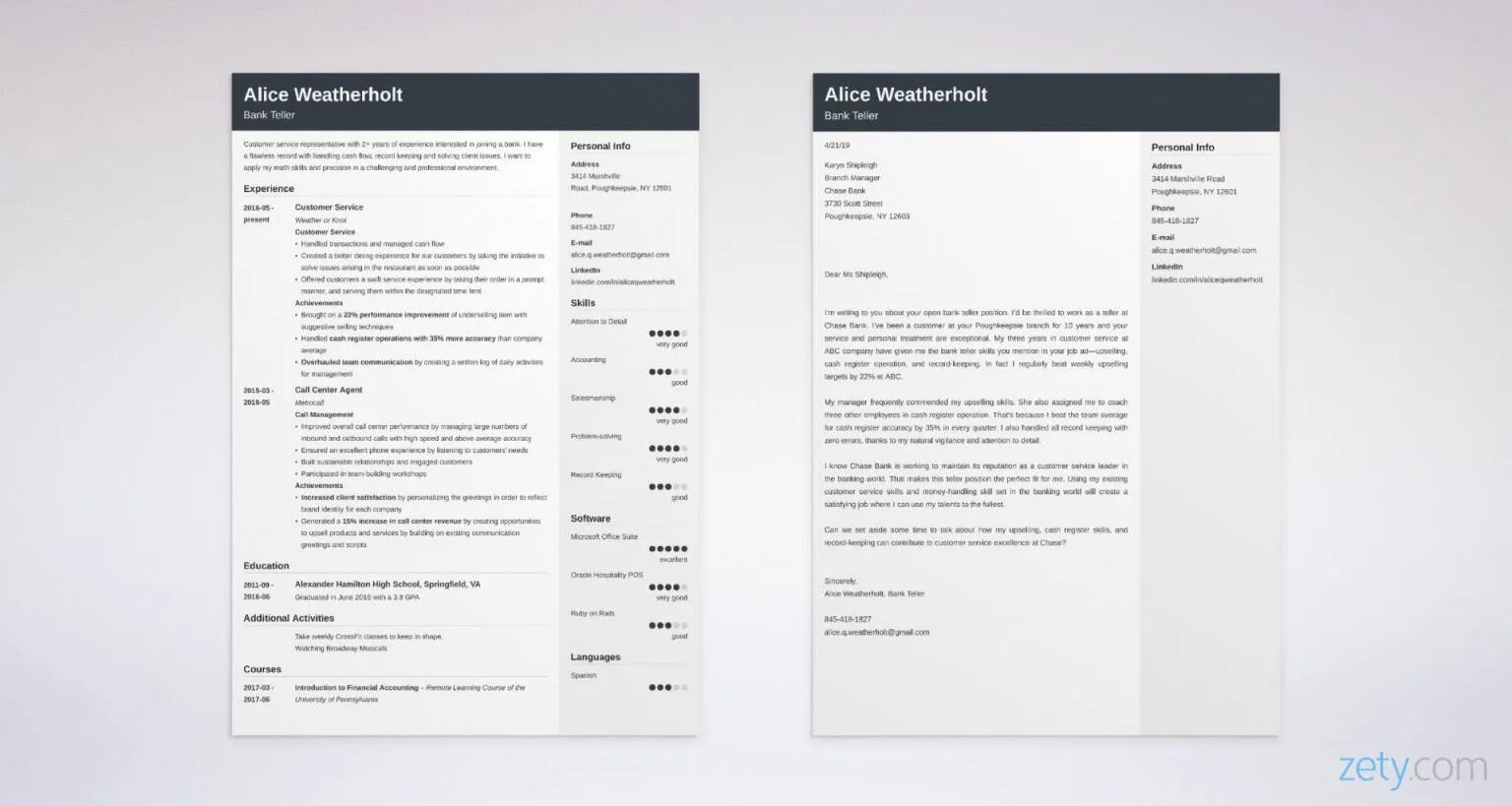

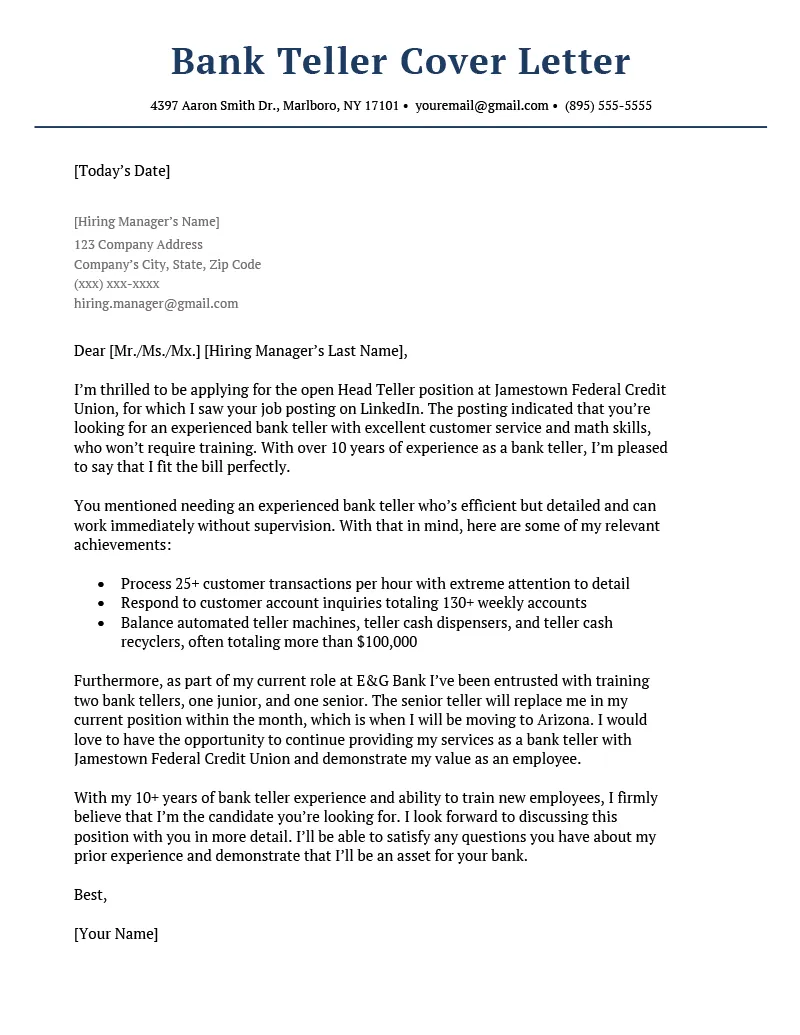

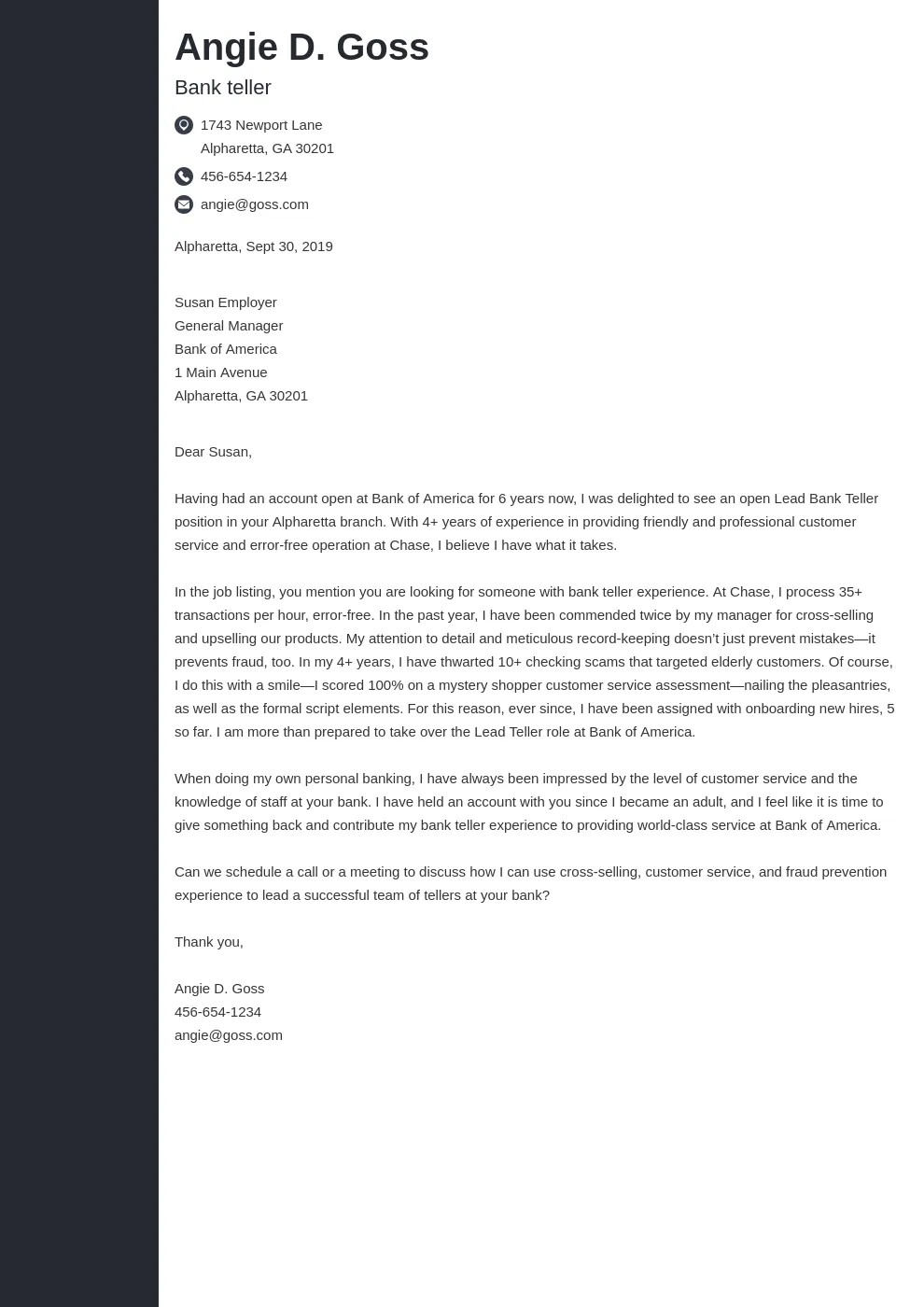

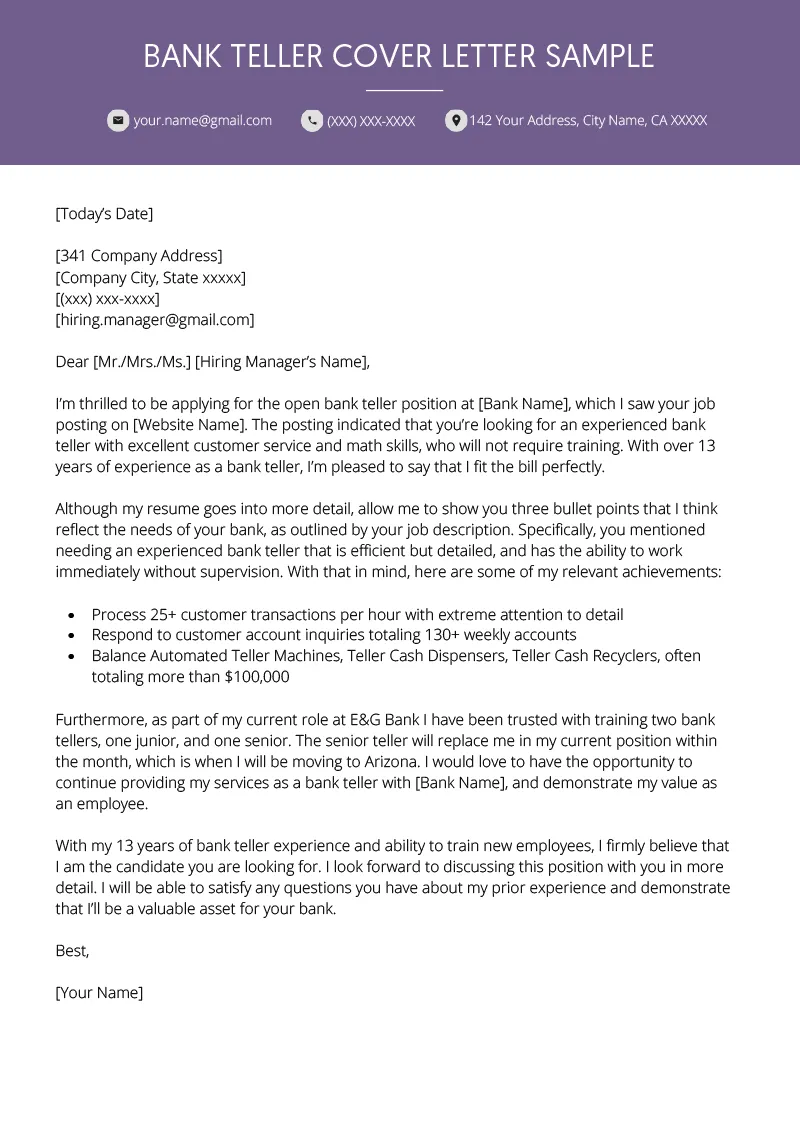

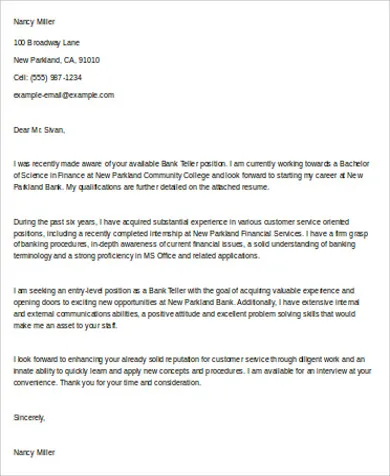

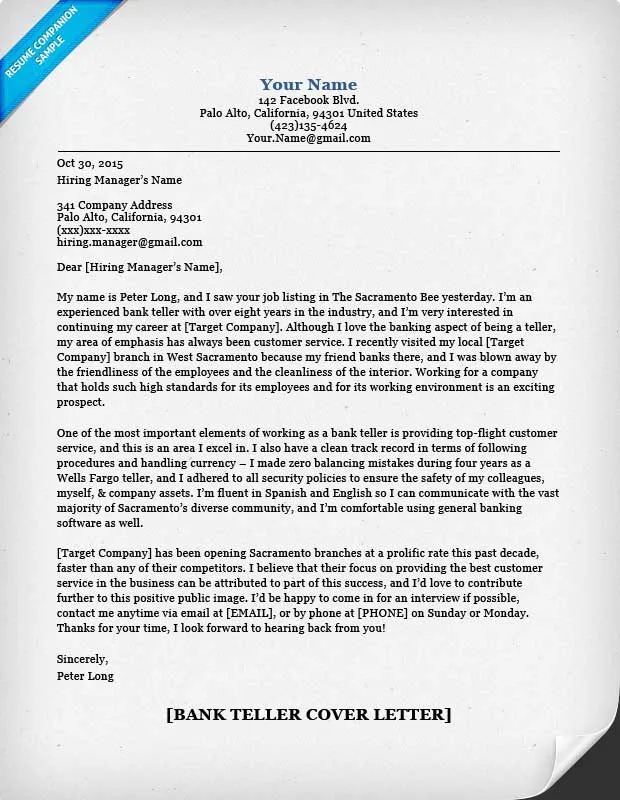

Bank Teller Cover Letter Examples

Reviewing bank teller cover letter examples can give you a better understanding of how to structure your own. Look for examples that match the specific requirements of the job you’re applying for. Pay attention to the tone, formatting, and language used in the examples. Use these samples as inspiration to create a cover letter that highlights your skills and experience. However, be sure to personalize your letter to reflect your unique qualifications. Don’t simply copy and paste; adapt the examples to fit your background and the specific job description. This is a very helpful step, especially if you are not sure of the format. Use the samples to get a better idea of how to organize your own cover letter and include the right information.

Entry-Level Bank Teller Cover Letter

When writing an entry-level cover letter, focus on transferable skills and any relevant experiences, such as customer service, cash handling, or basic math skills. If you lack direct bank teller experience, emphasize your enthusiasm and willingness to learn. Highlight any related coursework, volunteer work, or internships. Show that you’re a quick learner, detail-oriented, and eager to start your career. Use the cover letter to showcase your potential and your eagerness to make a positive contribution. If you do not have specific experience in the role, highlight skills that are relevant, and express your excitement and openness to learn and grow within the company. Your goal is to convince the hiring manager that you have the necessary skills, motivation, and the ability to succeed in the role. Stress the value of your existing capabilities.

Experienced Bank Teller Cover Letter

If you have previous experience as a bank teller, highlight your achievements, responsibilities, and successes in this role. Quantify your accomplishments whenever possible, such as the accuracy rate of your cash drawer reconciliations or the number of customers you assisted daily. Mention any awards or recognition you’ve received. Detail your knowledge of banking procedures, regulations, and customer service best practices. Emphasize any specialized skills or certifications. This is your chance to showcase your knowledge and experience in the field. Demonstrate your ability to handle complex transactions and to provide exceptional customer service. Focus on accomplishments, skills, and relevant experiences. Clearly demonstrate to the hiring manager that you’re a seasoned professional who can make an immediate impact. Demonstrate you’ve already mastered the skills needed for success.